How to reconcile your premium tax credit

How to Reconcile Your Premium Tax Credit

If you had a Marketplace plan and used a premium tax credit to reduce your monthly insurance payments, you’ll need to reconcile this credit when you file your federal taxes. Here’s what that involves:

Compare Two Amounts:

- The premium tax credit you received throughout the year, which was paid directly to your health insurance plan to lower your monthly payment.

- The premium tax credit you actually qualify for based on your final income for the year.

Impact on Your Taxes: Any difference between the credit you received and the amount you’re eligible for will either increase your refund or the amount of taxes you owe.

You should receive your Form 1095-A by mail no later than mid-February. It might also be available in your Marketplace account between mid-January and February 1. If you do not receive the form or if the information is incorrect, please contact the Marketplace Call Center.

For guidance on locating your 1095-A form online, see the detailed instructions provided.

How to Reconcile Your Premium Tax Credit

1.Obtain Your Form 1095-A

- You’ll need this form to reconcile your premium tax credit.

2. Download Form 8962 and Instructions

- [Form 8962](PDF, 110 KB) and its [instructions](PDF, 348 KB) are available for download.

Complete Part II of Form 8962

Use the information from your 1095-A to fill out this part of the form.

Find the Necessary Information

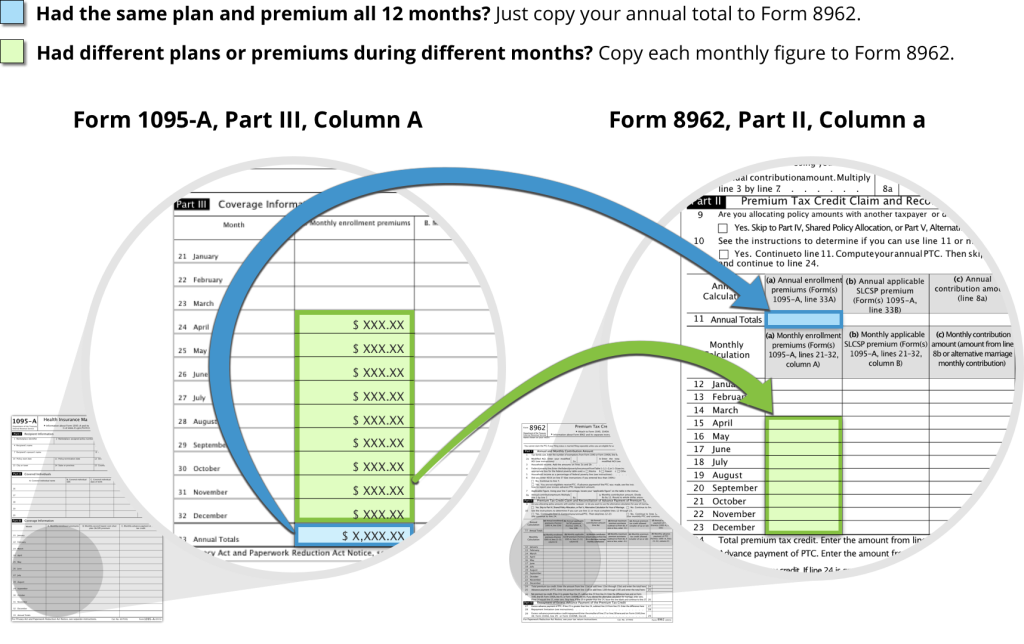

- Enrollment Premiums:

- Form 1095-A:

- Part III: Column A

- Annual Amount: Line 33

- Monthly Amounts: Lines 21 – 32

- Form 8962:

- Part II: Column A

- Annual Amount: Line 11

- Monthly Amounts: Lines 12 – 23

- Form 1095-A:

Transfer Enrollment Premium Information

- Same Plan for All 12 Months: Copy the annual total from Form 1095-A to Form 8962.

- Different Plans or Premiums: Copy each monthly amount from Form 1095-A to Form 8962.

Include the Second Lowest Cost Silver Plan (SLCSP) Premium

- Complete all relevant sections of Form 8962.

Calculate Your Reconciliation

- On Line 26 of Form 8962, determine if you used more or less premium tax credit than you qualify for based on your final 2023 income. This will affect your refund or tax due.

Submit Your Completed Form 8962

- Attach Form 8962 to your 2023 federal tax return.

What Happens if You Don’t Reconcile Your Taxes

If you had a Marketplace plan in 2023 but did not reconcile your 2022 taxes, you may lose any savings you’re receiving for your 2024 plan. Here’s what you need to know:

1.Notification from the Marketplace

You’ll receive a letter from the Marketplace outlining the necessary actions to take.

2.IRS Letter 12C

You might also receive “Letter 12C” from the IRS with further instructions.

3.Immediate Action Required

If you haven’t filed your 2023 tax return or filed but did not reconcile the premium tax credit for all household members, you need to address this immediately.

4.Confirm 2022 Tax Filing

If you’ve already filed your 2022 tax return, no further action is needed.

For additional information on your 2022 taxes or to verify your filing status, use the IRS’s Interactive Tax Assistant.